Coinbase investors fume as CPO cuts out early after pocketing $105M in stock sales

Chatterjee’s plush exit is eyebrow-raising even by the standards of overpaid executives. As noted by DLNews, which calculated his three-year take-home pay, Chatterjee last year made five times as much as the CEO of Ford. Meanwhile, the Ford CEO holds the most senior position at his company and has for the most part done a good job—unlike Chatterjee whose tenure will be best remembered for his bungling of Coinbase’s NFT rollout.

So it’s hardly a surprise that my tweet about Chatterjee’s departure elicited a torrent of jeering responses. Many were from crypto diehards who regard Coinbase as a bloated corporate sellout, but some came from exasperated investors. As one Twitter user lamented, “Hope he enjoys the shareholders cash—mine included.”

The frustration is understandable. For the millions of Coinbase shareholders who bought the stock when it was $200 or even $100, it would have been painful to watch as it shriveled to a low of $33—but doubly so to see wealthy Coinbase executives make bank by flooding the market with more shares. (The company’s COO made even more than Chatterjee from stock sales last year—$106 million—though she performed much better.)

The question is how much Coinbase’s board and its CEO, Brian Armstrong, are to blame for the Chatterjee debacle. Every company makes bad hires—check out Fortune’s latest list of the most overpaid CEOs—and, based on his MBA from MIT and a three-year stint as product VP at Google, the guy looked good on paper.

More broadly, Coinbase has been playing the same game as every other Silicon Valley company—and some outside of it—when it comes to executive compensation. That game entails competing for talent by offering reams of stock at cut rates (Chatterjee reportedly paid $18 per Coinbase share), a gimmick that lets young firms conserve cash while also letting them avoid treating salaries as expenses when it comes to reporting cash flows.

This often works out grand for companies and their executives, but for retail investors it can create a distorted picture of a firm’s financial outlook. As a finance professor put it in a recent Financial Times op-ed, “The bottom line is that if a company chooses to pay an employee with options or restricted stock, that action will affect the value of your share of equity in the company.”

In the case of crypto companies like Coinbase, it’s fun to imagine they will one day draw on the powerful governance tools offered by crypto—think of a DAO community voting to allot tokens based on performance—to create a fairer system of executive pay. But for now, the Surojit Chatterjees of this world will continue to get absurdly wealthy whether they deserve it or not.

Jeff John Robertsjeff.roberts@fortune.com@jeffjohnroberts

DECENTRALIZED NEWS

The team who raised money to build a widely hyped crypto game instead invested most of the funds on Genesis—where $20M is now stuck. (Fortune)

London-based crypto exchange Luno axed around 35% of its 960 employees. (CNBC)

The twin brothers who founded NFT platform Nifty Gateway, later acquired by fellow twins the Winklevii, are stepping away from Gemini. (The Block)

Tesla did not buy or sell any of its Bitcoin holdings during Q4. (CoinDesk)

Kraken poached Blockchain.com’s chief compliance officer, who previously did stints at the Securities and Exchange Commission and Deutsche Bank. (WSJ)

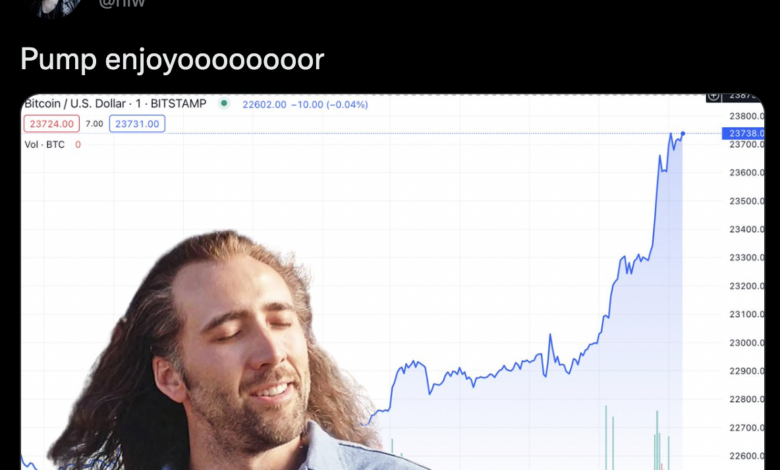

MEME O’ THE MOMENT

More Bitcoin bros enjoying the price surge: