Payment Service Providers (PSP) – Definition, Working, and Benefits

Over the past decade, more and more payment options have become available for customers to make online payments, making them more convenient than ever. Due to this trend, any business can benefit massively from offering multiple payment options to its customers. This helps in acquiring new customers, as well as retaining current ones. However, maintaining a growing number of payment options can create a lot of extra costs, labor, and security issues. This is where Payment Service Providers (PSPs) can help.

What are Payment Service Providers (PSPs)?

PSPs (also called Merchant Service Providers) are third-party companies that help business owners accept a wide range of online payment methods, like online banking, credit cards, debit cards, e-wallets, cash cards, and more. Basically, they make sure your transactions make it from point A to point B, safely and securely.

PSPs see to it that transactions are completed — from the start, when a customer enters their details and initiates a payment, to finish, when you receive it.

How does a Payment Service Provider work?

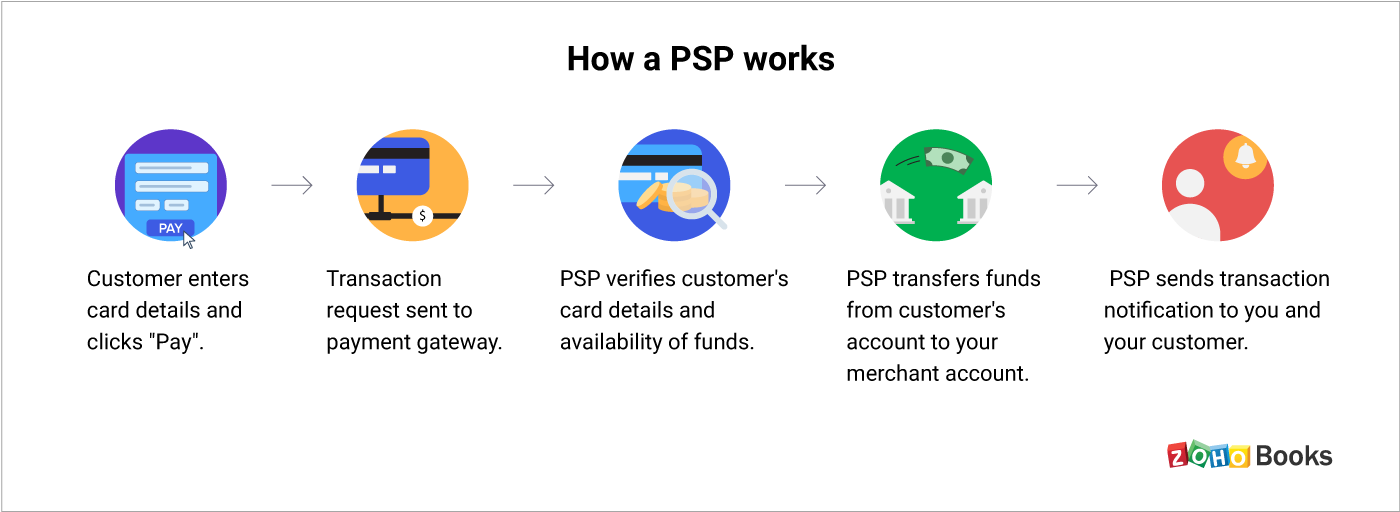

To see how a PSP works, let’s go through an example of a basic online transaction — from the moment it’s initiated, to the moment you see the funds in your account:

- After a customer enters his card details and clicks ‘pay’, a transaction request is sent to the payment gateway you’ve signed up with.

- The PSP then verifies the customer’s card details and checks whether the customer has enough funds in their card account to make the payment. The PSP does this with the help of a payment processor.

- Once the customer’s card details are verified and it’s been confirmed that the customer has sufficient funds in their account, the PSP initiates a transfer of funds from the customer’s bank to the merchant account you have associated with your business.

- Finally, the PSP sends a transaction notification to you and the customer about the completed payment.

In the case of a declined transaction for reasons such as invalid card details or insufficient funds, the PSP will terminate the transaction and send a status message notifying you and your customer of the failed payment.

In summary, a PSP ensures the safe and successful transfer of funds from your customer’s account to yours. That being said, there are other benefits that PSPs offer business owners in addition to facilitating payments. Signing up with a PSP offers several advantages, from transaction reporting, to the ability to accept multiple payment methods in multiple currencies.

Let’s look at a few additional advantages of using a PSP.

What are the advantages of using a PSP?

Accept multiple payment methods:

PSPs provide support for several payment methods through a single channel, ensuring your customers can conveniently choose from a variety of options. This level of accessibility helps ensure customer satisfaction. Integrating different payment methods such as online banking, credit cards, debit cards, and e-wallets to your business can incur costs. Signing up with a payment service provider can save you from much of these. There are only two types of fees you need to pay: a one-time set-up fee, and a small monthly fee for enabling payments.

Make transactions securely:

All information sent through a transaction request is controlled by the PSP. This information is heavily encrypted using SSL (Secure Socket Layer) encryption, ensuring only the customer can view their banking or financial information. This provides customers a better sense of security, and encourages them to go through with the payment.

Prevent fraud:

PSPs only initiate transfer of funds once the customer’s card details have been verified and if it locates the sufficient funds required for the payment in the customer’s account. If not, the transaction is terminated. This helps avoid your business being compromised by fraudulent transactions.

Accept multiple currencies:

In addition to multiple payment methods, PSPs also provide support for multiple currencies. This allows fast and secure payments from customers around the world. This is important if you’re planning to expand your business beyond your own country. However, this is only possible if the PSP works with a payment processor that is capable of processing the desired currencies.

Get monthly reports on payments:

Most PSPs offer you monthly reporting features for payments and transactions made to your business. There are some PSPs who offer real-time reporting features, but these can be more expensive.

Add new payment methods easily:

PSPs allow you to add new payment methods, easily. There are increasingly more new payment options being created now, which make it more convenient for customers to make payments. Keeping up-to-date with these novel payment methods ensures that your customers find it convenient and simple to purchase your product or service. PSPs remain up-to-date with the latest payment methods, and typically, automatically make them available to you.

Opening accounts with acquiring banks:

Before accepting card payments, you will have to set up a merchant account for your business with an acquiring bank. PSPs can help with this application process and reduce the usual waiting period you will need to go through when opening a merchant account. PSPs can also have preexisting accounts with acquiring banks that they work with. Once signed up with a PSP, businesses can get sub-accounts under these preexisting accounts, making the process of setting up merchant accounts much easier, as these accounts are already approved and functioning.

Reconcile transactions easily:

PSPs provide complete transaction reports for every one of your payment methods. This makes it easier for you to reconcile transactions in the future.

Get a PSP for your business!

In summary, Payment Service Providers can help you reduce integration and processing costs, accept multiple payment methods and currencies, and safely and securely facilitate your payments. If you’re looking to expand your business, you will need to start accepting a wider variety of payments from your customers, allowing them to pay through whichever method they prefer. If this sounds like the direction you want to head in, consider working with a PSP.