Remitano

Remitano Review

What is Remitano?

Remitano is an online platform that provides an escrowed P2P crypto marketplace that supports the buying and selling of cryptos. It is registered in the Seychelles and run by the company Babylon Solutions Limited (registration number 168830). The exchange has been around since 2016, which in the world of cryptocurrency is a long time.

Supported Cryptos & Fiat Currencies

Currently, the Remitano platform supports the deposit and withdrawal of 6 of the most popular cryptocurrencies that include Bitcoin (“BTC”), Bitcoin Cash (“BCH”), Ethereum (“ETH”), Litecoin (“LTC”), Ripple’s XRP (“XRP”), and USD Tether (“USDT”).

Additionally, depending upon jurisdiction, Remitano permits the deposit and withdrawal of the following fiat currencies: Indian Rupee, Indonesian Rupiah, Malaysian Ringgit, Nigerian Naira, Vietnam Dong and Venezuelan Bolivar.

Swap and Invest

By depositing crypto or fiat, investors may invest into crypto with 2x margin or swap for other Remitano supported crypto.

Additional cryptos available via the swap and invest platforms include Binance Coin (“BNB”), Cardano’s ADA (“ADA”), Chainlink (“LINK”), EOS (“EOS”), Ethereum Classic (“ETC”), Monero’s XMR (“XMR”), NEO (“NEO”), Stellar’s Lumen (“XML”), Tezos (“XTZ”), and Tron’s TRX (“TRX”).

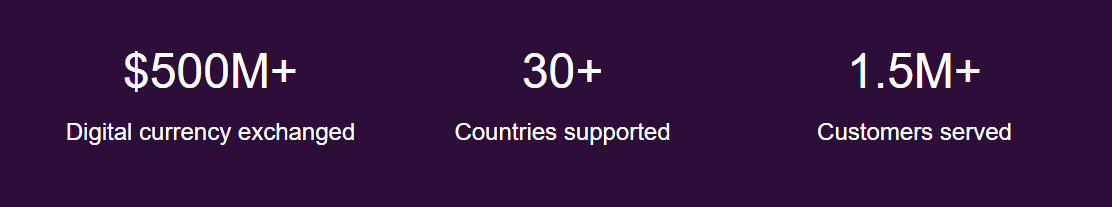

Statistics

This exchange provides services to 30+ countries. A few more statistics below:

US-investors

Remitano does not list US-investors as prohibited from trading, but US-investors should – as always – do their own independent assessment of any problems arising from their residency or citizenship. In a worst-case scenario, they may not be able to trade at one or several exchanges that could be the best cryptocurrency exchange site for them (maybe including this one).

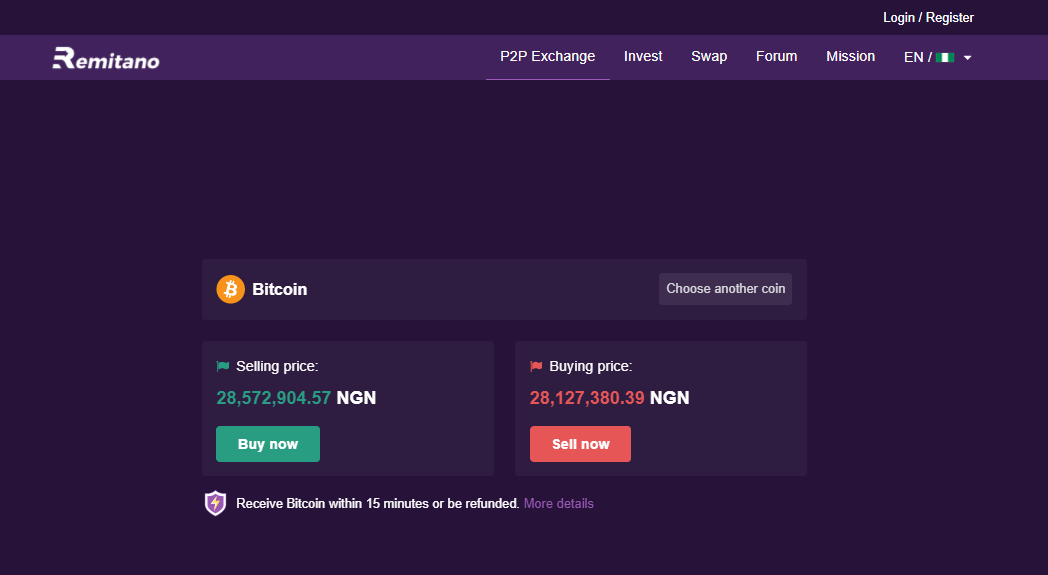

Remitano Trading View

Different exchanges have different trading views. And there is no “this overview is the best”-view. You should yourself determine which trading view that suits you the best. What the views normally have in common is that they all show the order book or at least part of the order book, a price chart of the chosen cryptocurrency and order history. They normally also have buy and sell-boxes. At this exchange, there is only an order box. This makes it easily understandable for new crypto investors, while it will definitely lack some features that more experienced traders look for. The below is a picture of the purchase interface at the landing page of Remitano:

You can also easily switch into other coin markets by clicking on the “Choose another coin” button. The interface that will then display is the following:

Remitano Fees

Remitano Trading fees

Every trade occurs between two parties: the maker, whose order exists on the order book prior to the trade, and the taker, who places the order that matches (or “takes”) the maker’s order. Makers are so named because their orders make the liquidity in a market. Takers are the ones who remove this liquidity by matching makers’ orders with their own.

EXAMPLE:

Ingvar, offering to buy 1 BTC for USD 10,000. And Jeff, offering to sell 1 BTC for USD 11,000. If Bill comes along, and sells 1 BTC to Ingvar for USD 10,000, he takes away Ingvar’s order from the order book. Bill is here a taker and will be charged the taker fee. If Bill on the other hand would have offered to sell 1 BTC for USD 10,500, he would have placed an order on the order book that did not correspond to an existing order. He would thus have been a maker of liquidity. If someone would have accepted to buy 1 BTC from Bill for USD 10,500, then Bill would have been charged the maker fee (usually a bit lower than the taker fee) and the relevant buyer would have been charged the taker fee.

The way that Remitano charges fees are explained in the below picture:

As is evident from the above explanation, Remitano is a P2P marketplace. Accordingly, it is difficult to compare the fees charged by Remitano with the industry average trading fee at a regular centralized exchange (0.217% for takers and 0.164% for makers, according to the latest market industry report on the subject).

We have not performed any conclusive research on the fee averages of P2P marketplaces, but we have no reason to believe that 1.00% for takers should be considered as particularly high.

Remitano’s doesn’t charge makers any fees at all. This is a very strong competitive edge in the market and is especially beneficial for the investors not interested in picking up existing orders from the order book but rather prefers to “go fishing” with maker-orders.

Remitano Withdrawal fees

Remitano’s withdrawal fee is 0.0005 BTC per BTC-withdrawal. This fee is far below the industry average.

According to the latest empirical study that we have performed on Cryptowisser.com, the global industry BTC-withdrawal fee is 0.000643 BTC per withdrawal. In comparison with this, 0.0005 BTC is quite competitive.

The exchange has however informed us that this fee may be updated anytime due to the high network fee.

Deposit Methods

Remitano offers both wire transfers and credit card deposits as deposit methods. Seeing as Remitano accepts deposit of fiat currencies, it distinguishes itself from many exchanges that only allow deposits in cryptocurrencies.