Top-Rated Crypto Token Sales — List of New Crypto Coins: ICOs, STOs, IEOs and IDOs

Blockchain Companies & Crypto Startups of 2024

Nowadays, it is obvious that crypto traders do not always have time or knowledge to learn all the important aspects of investing in crypto projects, even if they are very easy to understand and apply. In a market as volatile as the crypto market, psychological aspects behind ICOs, STOs, IDOs or IEOs can play a greater role than anything.

CryptoTotem is an independent crypto project database for investors and crypto enthusiasts. We eliminate bad investment decisions with our useful services that are constantly updated: we present fresh ongoing, pre-sales or upcoming crowd sales, and compares various project ratings of the best agencies. It helps our investors save considerable time in searching for profitable investments. Our mission is to provide all possible reliable and up-to-date information about each project in the crypto industry.

Frequently Asked Questions

What does an ICO mean?

An Initial Coin Offering or Initial Token Offering (ITO) is a type of project or startup financing that is conducted with the help of issuing coins (or tokens). Tokens are purchased by participants (investors) in return for an eligible payment instrument (e.g. fiat currency) or cryptocurrencies such as Bitcoin or Ethereum. The value of those tokens depends on the project viability and can grow far higher later. In terms of technical framework, ICOs are associated with Blockchain and smart contracts.

What is Blockchain?

Blockchains are decentralized and secure databases. This concept was introduced by mysterious Satoshi Nakamoto in 2008 and put into action as part of the cryptocurrency named Bitcoin. Basically, Blockchain acts as a public account book that keeps all Bitcoin transactions and allows distributing digital data so that not a single entry can be retrospectively modified. This technology can find—and already finds—use in various verticals including finance, real estate, health care, etc.

What is Smart Contract?

A smart contract is a computer protocol intended to ensure transparent performance of a contract, in digital form and with no third party involved. Smart contracts help negotiate, exchange valuable assets, shares, or money in a conflict-free way. The term was coined in 1994 by American cryptographer Nick Szabo. What constitutes the cornerstone principle of a smart contract is complete automation and accuracy of performance of contracts.

What is a White Paper?

A white paper is the main official document of a project participating in an ICO, IDO, IEO, or STO. Being a definitive guide, it may affect investors’ decision-making. The document helps readers tap into a problem and presents an intended solution to the described issue.

What is the difference between ICO and IPO?

An Initial Public Offering (IPO) is a process in which company shares can be openly purchased—this is how a private company can go public. The main difference is that IPOs are carried out for established companies while ICOs, usually, are endeavors of high-risk market newcomers.

Is ICO legal?

An ICO can be regulated by local law (e.g. corporate licensing). But, as long as tokens are distributed across different jurisdictions, ICOs cannot be limited to local issues. In July 2017, the U.S. Securities and Exchange Commission declared it may be entitled to apply the Securities Act to ICOs. Whether law is applied or not will depend on specifics of every particular case. Please refer to the SEC guidance.

What is an STO?

An STO is, basically, a token offering by virtue of crowdfunding. Tokens can be underpinned by company assets (e.g. shares), dividend right, or voting right. A security token allows its holder to vote and is being regulated by the SEC. This limits the range of potential investors that are eligible to sponsor the instrument.

What is IEO?

An Initial Exchange Offering (IEO Launchpad) is the process during which tokens or coins are being sold under the control of a crypto exchange. Just like ICOs, IEOs allow investors to get new tokens; the only difference is that, within an IEO, tokens are distributed over the exchange that has specific commitments associated with every project it supervises.

How do I find a good ICO, STO, IDO or IEO?

Here’s the safest guide to finding the best crypto project to engage in:

- Look at the projects listed on our platform

- Best projects have respected and trusted developer teams

- Best company is venture financing

- Community support

- Scrutinize the White Paper and project Roadmap

- Read the Code

What a cryptocurrency and digital assets are

A cryptocurrency is an encrypted digital currency used for different exchanges of value and online transactions. Coins and tokens hold flexibility and are treated as equivalent to physical currency in terms of exchange of goods or services. To date, there are over 5,000 crypto assets spread all over the world and a total market capitalization of over $245 billion.

Bitcoin and altcoins offer high potential for profits with enough trading opportunities. Due to its high volatility, crypto traders can take various parts of these digital currencies and determine their positions for profit. It’s vital to differentiate between coins and tokens, as they are often confused.

Four common types of digital assets are utility-tokens, security, stablecoins, and cryptocurrency.

The term altcoins refers to a cryptocurrency that is an alternative to Bitcoin. Most altcoins are variants built on Bitcoin’s open-source and original protocol but with changes to its source codes (Fork). Hence, an altcoin is a brand new piece of the digital coin with different features and protocols.

Tokens, on the other hand, are a representation of an asset or utility, which are created on other Blockchains (Ethereum, for example). They can represent assets that are tradable, from products to services and to even other cryptocurrencies! Creating tokens does not require modification of source codes or creating a new Blockchain. They are created and distributed through ICOs, STOs, DAICOs, ETOs, IDOs, or IEOs, which is a strategy for crowdfunding and financing the development of a new startup.

What an ICO (Initial Coin Offering) is

ICO stands for an Initial Coin Offering. It is also regarded as an alternative form of crowdfunding for releasing a new crypto unit.

Startups use ICOs as a means to raise development funds. They have been used to raise millions of dollars for blockchain-related projects.

ICO is one of the easiest and most effective ways to attract investments. For every new cryptocurrency, the company or individual will need to source funds needed for all the technical development, so they usually sell tokens in exchange for major currencies such as Bitcoin (BTC) or Ether (ETH). ICO periods usually last at least a week.

There are different forms of ICOs with specific timeframes and goals. An example of an ICO may include having a pre-designated price for all tokens sent out during the ICO. In such a case, the token supply is static. However, a static token supply may include a dynamic funding goal which determines token distribution based on funds received.

One of the most successful ICO projects is Ethereum, which had ether as their tokens. Only Ethereum ICO was able to garner up to $18 million dollars in BTC during their crowd sale. The project started in 2015 and already had a huge increase in price by 2016 with a market capitalization of more than $1 billion.

A lot of people confuse an ICO with an IPO (Initial Public Offering), but they have a lot of differences. In fact, an ICO doesn’t give you any kind of ownership of the company trying to create its own crypto unit. Tokens distributed from an ICO will gain value, with the ICO allotting equity equivalent to the token, which gives the company or investor ownership with voting rights and qualification for dividends.

In highlighting the top ICOs, there is no sure-fire way of distinguishing good projects from bad ones. At CRYPTOTOTEM, we help our investors assess risk by systematically reviewing the objectives behind different offerings, using structured criteria.

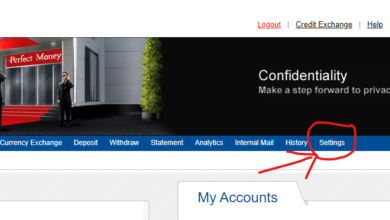

What an ongoing ICO is

CryptoTotem’s list of ongoing projects is all you need to decide which tokens to get right now. Our list features a comprehensive selection of various cryptocurrency ICO/STO/IEO/IDO reviews, ratings, and other details. Each company page gives you a brief description of the project, how far it already is into the crowdfunding campaign, and how much time you have to buy coin or token. Based on various variables with the most important being potential for profit and quality, we rate our projects using a ten-point system. Check out ongoing ICO listing here.

What a pre-ICO is

Pre-sales allow crypto investors and companies to get tokens “before” a crowd sale begins. Most frequently, such pre-sales generate less funds and give out tokens at a much lower price. A pre-sale that offers a bonus of 30-50% or more compared to the public-sales price is not an uncommon thing.

Pre-sales employ smart contracts different from those used in the main launch. This prevents mixing of main funds with pre-sales funds and enables easy account audit and reconciliation.

Several cryptocurrency projects use pre-ICOs to garner funds to finance expenses that would be incurred during the main ICO. Those expenses may include paid strategic recruitment, promo ads, and other costs to awaken and maintain the interest of investors.

A unique opportunity for quick profit, it can affect the project’s credibility and appeal when a lot of tokens are at dips. Transparency is key to any business.

In launching pre-sales or private-sales, money raised and the number of tokens issued must be significant and open to investors. Check out our quality list of pre-ICOs here.

What an upcoming ICO is

This list will help you stay on top of all the Blockchain startups that will be launching soon. You won’t be able to invest, but the listed projects already have a good presence and community for their official public sale.

If one or more upcoming projects on our list interests you, you are advised to whitelist in order to ensure you invest in their ICO, IEO, IDO, or STO and join their community. Whitelisting means you will be notified of the token sales before the general public sale or pre-sale. The most complete list of upcoming ICOs is here.