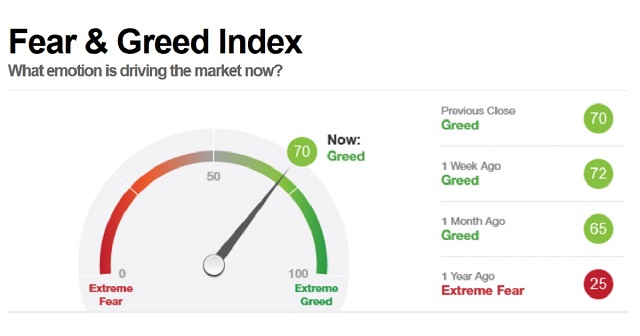

Crypto Fear and Greed Index – Bitcoin Momentum Tracker

The Crypto Fear and Greed Index provides a score of 0 to 100, categorising bitcoin sentiment from extreme fear to extreme greed. Many crypto traders use the index to help them find the right time to enter and exit the market. In this guide, we cover everything from how it works to how you can use it to help you trade.

Crypto Fear and Greed Index: Live

What is the Crypto Fear and Greed Index?

The Crypto Fear and Greed Index uses social signals and market trends to determine the overall sentiment of the crypto market, based on bitcoin and other large cryptocurrencies. It’s called an index because it takes multiple data sources and combines them into a single figure.

The index is divided into the following four categories:

- 0-24: Extreme fear (orange)

- 25-49: Fear (amber/yellow)

- 50-74: Greed (light green)

- 75-100: Extreme greed (green)

How to use the Crypto Fear and Greed Index?

As you’re probably well aware, the crypto market can be volatile at times. This is in part due to emotional investors reacting to the market. People can feel FOMO (Fear Of Missing Out) and get greedy when the market is rising. They also can become fearful when the market is falling and sell their coins.

Many traders use the index as a market indicator, a tool that gives them information about the market to help them trade smarter. Analysing the overall sentiment and the emotions driving the market has helped many traders outperform the market.

Here’s how the creators of the index suggest it can be used to help you trade:

- Extreme fear could be a buying opportunity because investors are too worried.

- Extreme greed could mean that investors are too greedy and the market is due for a correction.

How is the Crypto Fear and Greed Index calculated?

The index is calculated by Alternate.me using a range of sources: volatility, market momentum/volume, social media, dominance, and trends. Surveys have also been used in the past, but are currently paused. Also, the signals are based on bitcoin, but other large cryptos like ethereum may be incorporated into the index soon.

Here’s a closer look at each of the five key signals:

- Volatility – A rise in volatility is used as a sign of a fearful market.

- Market momentum/volume – The current market momentum is compared to the current volume. When buying volumes are outpacing the longer term momentum, it signals the market is getting too greedy.

- Social media – Using a Twitter sentiment analysis tool, an unusually high interaction rate is used to identify greedy market behaviour.

- Dominance – A rise in bitcoin dominance is considered a sign of a fearful market moving to a safer asset, while a fall in bitcoin dominance is seen as a sign the market is getting too greedy and moving to more speculative altcoins.

- Trends – Data from Google Trends is used to see how many people are searching for information about bitcoin. An increase in certain search terms such as ‘bitcoin price manipulation’ is considered a fearful signal, while ‘bitcoin price prediction’ would be considered more bullish.

Insights from the Crypto Fear and Greed Index

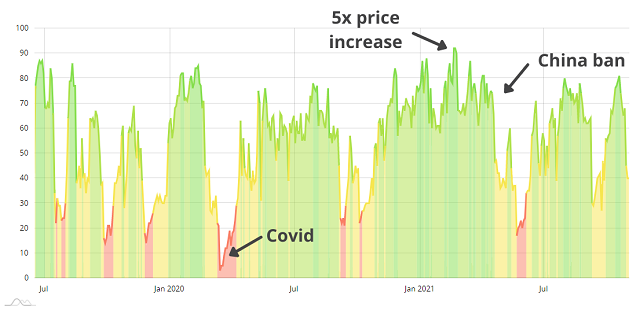

This historical chart of the Crypto Fear and Greed Index from BTC Tools. It shows us how bitcoin sentiment has changed over the longer term, specifically from June 2019 to October 2020.

As you can see, the index generally sits in the greed range and rarely drops into extreme fear for more than a month. It also shows us bitcoin sentiment has correlated with major events in crypto over the past two years.

We can see that the index hit its lowest point in March 2020, as panic about the coronavirus spread and both financial markets and the crypto markets sold off, including Ethereum, Litecoin, Terra, and Ripple.

Notably, it hit its highest point in February 2021 following the run from AU$10,000 to AU$50,000. That period also coincided with the massive profit opportunities of ‘DeFi summer’. As you can see, it stayed there for over a month before news of China’s mining ban broke and it dropped precipitously.

At a broader level, this chart reveals two important things about the Crypto Fear and Greed Index. Firstly, it can change incredibly rapidly as news breaks or prices slide. Secondly, it can stay in the greed and extreme greed levels for extended periods.

Overall, it shows that bitcoin’s sentiment has been overwhelmingly positive for the past two years.

Is it a short-term or long-term indicator?

As you can see from the historical chart, the Crypto Fear and Greed Indicator doesn’t correspond tightly to longer-term bull runs. Rather, it reacts to news events and short-term changes in the crypto market. For those reasons, many traders use it primarily as a short-term indicator rather than as a long-term indicator. As you might expect, it’s especially popular among traders.

How can I control my own emotions when investing?

Looking at the Crypto Fear and Greed Index, we can see how the overall market can behave irrationally in the short term. As individual investors, we ask ourselves, how can I control my emotions and not let greed or fear drive my investing decisions?

Here are some strategies that many traders use to manage their emotions when making decisions:

1. Be fearful when others are greedy and greedy when others are fearful

Many traders use the index as a way to follow Warren Buffett’s aphorism of being “greedy when others are fearful and fearful when others are greedy.” Pay attention to the Crypto Fear and Greed Index to see if you’re getting caught up in the emotions of the digital currency market.

Morgan Stanley has advised readers to “Tune out irrelevant information and noise, and resist the urge to follow the crowd.”

2. Use the dollar cost averaging investment strategy

Dollar-cost averaging (DCA) is a popular investment strategy in the cryptocurrency industry because it helps remove emotions from investing. The strategy involves making regular small investments over time, rather than trying to time the market with one big investment.

3. Diversify

Analysts from the investment bank Morgan Stanley recommend that investors “Develop a strategy that diversifies your investments across different asset classes and investment vehicles to minimise systemic and asset-specific risk.” They see this as a way to help manage your emotional response during market volatility.

Did you know that CNNMoney inspired the Crypto Fear and Greed Index?

The finance channel CNNMoney originally developed a Fear and Greed Index for stocks. It looked at how far several indicators had deviated from their averages to give the stock market an overall rating between 0 and 100. While the Crypto Fear and Greed Index uses different indicators, the idea was certainly inspired by CNN.

Where can I access the Crypto Fear and Greed Index?

Many traders check this indicator daily as it gives them a quick sense of the market. When it hits extreme greed or extreme fear, they often take it as a signal to look at all of the trading signals more closely. They most often check financial metrics like supply and demand or market capitalisation and sometimes dive deeper with on-chain indicators.

Here’s where you can check the index most easily:

- Use this page. The image at the top of this page is automatically updated daily, so you can always see the latest Crypto Fear and Greed Index reading. Bookmark this page and check it daily.

- Visit the creators of the index, Alternative. They also show index values for yesterday, last week, and last month.

- Follow the Bitcoin Fear and Greed Index Twitter account. You’ll receive updates of the index in your Twitter feed.

Want to learn more about crypto? There are heaps more articles to explore on our learning hub, whether you’re a complete beginner or trading expert.

Disclaimer: Information provided is for educational purposes and does not constitute financial product advice. You should obtain independent advice from an Australian financial services licensee before making any financial decisions.